Tasmanian Small Business Tariffs

Aurora define a ‘Small Business’ as a Business not on an electricity contract, and that uses less than $30,000 of electricity per site per year.

Alternatively, 1st Energy define a ‘Small Business’ as any entity with an ABN, whose annual energy consumption is <100MW per year.

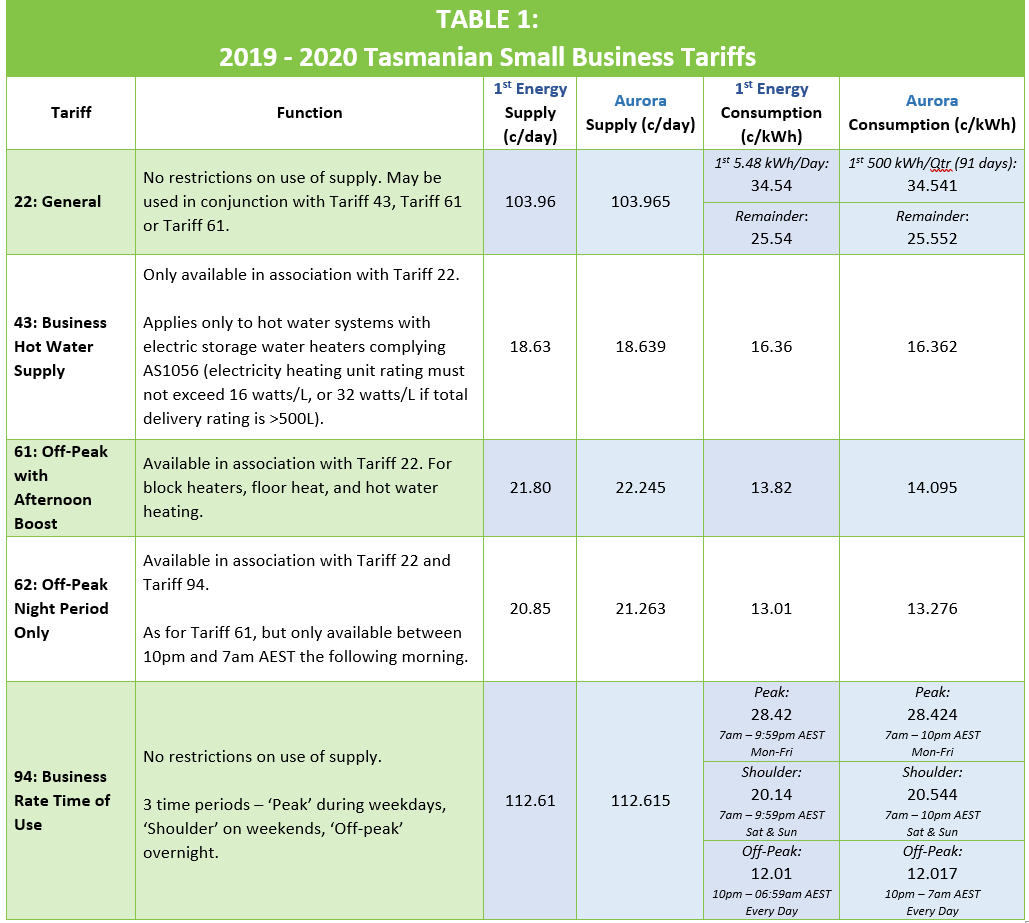

Tables 1 & 2 provide a brief summary of current Tasmanian Small Business Tariffs, current as at 13 August 2019 (click to enlarge):

As a matter of interest, both cost of supply and cost of energy consumption has increased ~ 2% from the 2018-2019 financial year.

It is worth noting that if connection is required for only relatively short, specific periods of the year (e.g. to power chillers during fruit harvest), it may be more cost effective to connect to Tariff 94: Time of Use for the duration of that time, and then disconnect at the end of that period to avoid the higher supply fees.

Tariffs and Solar Installation

As is evident, power is not cheap. To reduce the financial and environmental cost of electricity, an increasing number of Businesses are offsetting power consumption by installing solar photo-voltaic systems. This enables the Business to generate power for self-consumption, and to export surplus power back to the grid.

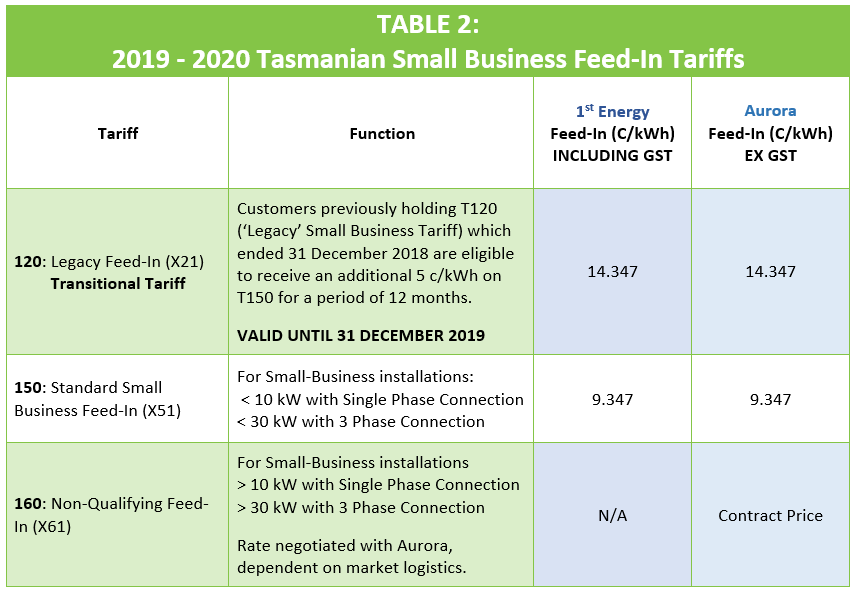

Surplus power is purchased by Aurora at a rate according to the applicable Feed-In Tariff. Table 2 outlines the Feed-In Tariffs available to Small Businesses in Tasmania:

The standard feed-in tariff for Small Business has increased by 0.806 c/kWh from the 2018-2019 financial year.

Agribusiness

A sub-class under ‘Small Business’ in Tasmania is Agribusiness.

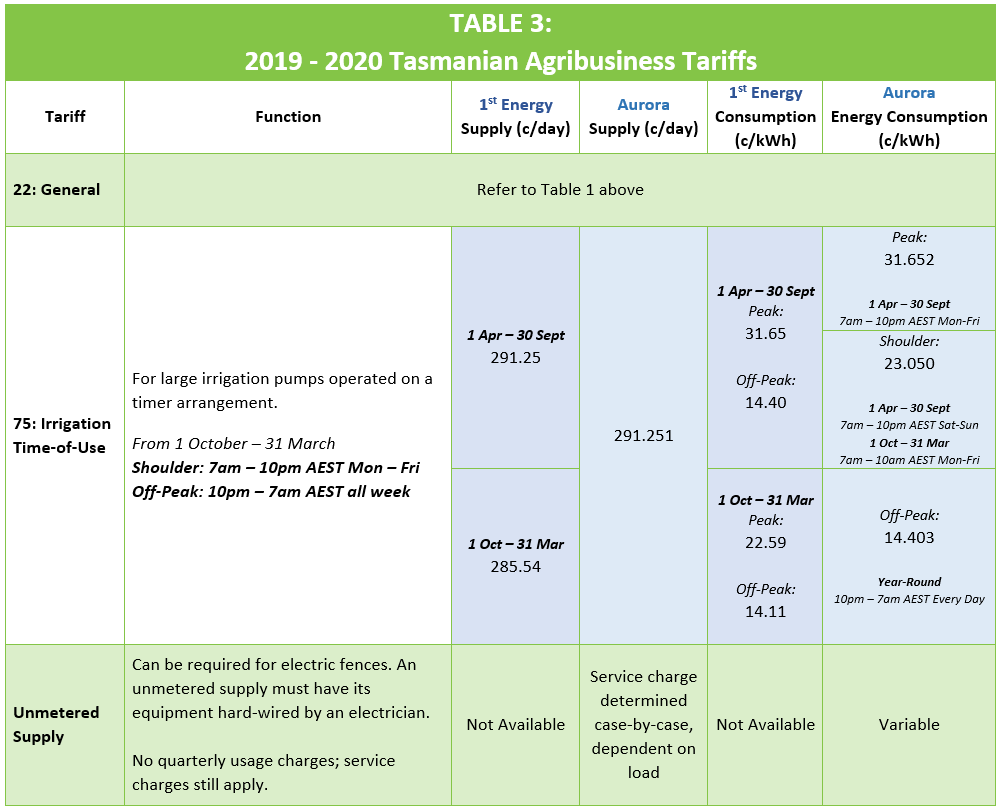

Agribusiness refers to land used for farm operations, and must be used for approved agricultural purposes as classified by Australian and New Zealand Standard Industrial Classification (ANZSIC) Division A, Subdivision 01: Agriculture. Table 3 summarises the Tariffs most relevant for Agribusiness.

As a matter of interest, both cost of supply and cost of energy consumption has increased 2% from the 2018-2019 financial year.