STCs

28 Jul, 2017

Small-scale Technology Certificates (STCs) form the basis of a government financial incentive to reduce the cost of ‘small-scale’ (<100kW) renewable energy systems.

The number of STCs allocated to each system varies according to:

- geographic location

- installation date

- the amount of electricity (MWh) that is either generated (solar, wind or hydro) or displaced (solar or heat-pump hot water) over a specific period of time.

Sale of STCs enables the owners of small-scale renewable energy systems to recoup a portion of the cost of purchasing and installing a system.

The process of registering and trading STCs can be quite involved.

To save customers this inconvenience, many installers (including MODE) offer to process the STCs for an installation as part of their service to customers, and calculate the value of STCs as a discount (our ‘government financial incentive’) in their quotes.

The value of STCs has recently plummeted. To understand why, it’s helpful to know the context in which STCs are created and traded.

Value of STCs

The trading value of STCs is centred around Australia’s Renewable Energy Target, a government scheme introduced in 2001 and geared to ensuring at least 20% of Australia’s energy generation will come from clean energy by the year 2020.

The Renewable Energy Target is split into 2 parts:

- The Large-Scale Renewable Energy Target

- The Small-Scale Renewable Energy Scheme

Under the Small-Scale Renewable Energy Scheme, Renewable Energy Target Liable Entities (primarily electricity retailers) have a legal obligation to buy and surrender a specified amount of STCs on a quarterly basis.

The size of the market for STCs is set every year by the Clean Energy Regulator (the federal government body responsible for overseeing implementation of the Renewable Energy Target), based on how many small-scale renewable energy systems they expect to be installed for the year ahead.

This projection determines the number of STCs Liable Entities are obliged to acquire for that year, based on a percentage of the anticipated STC creation.

Current Market

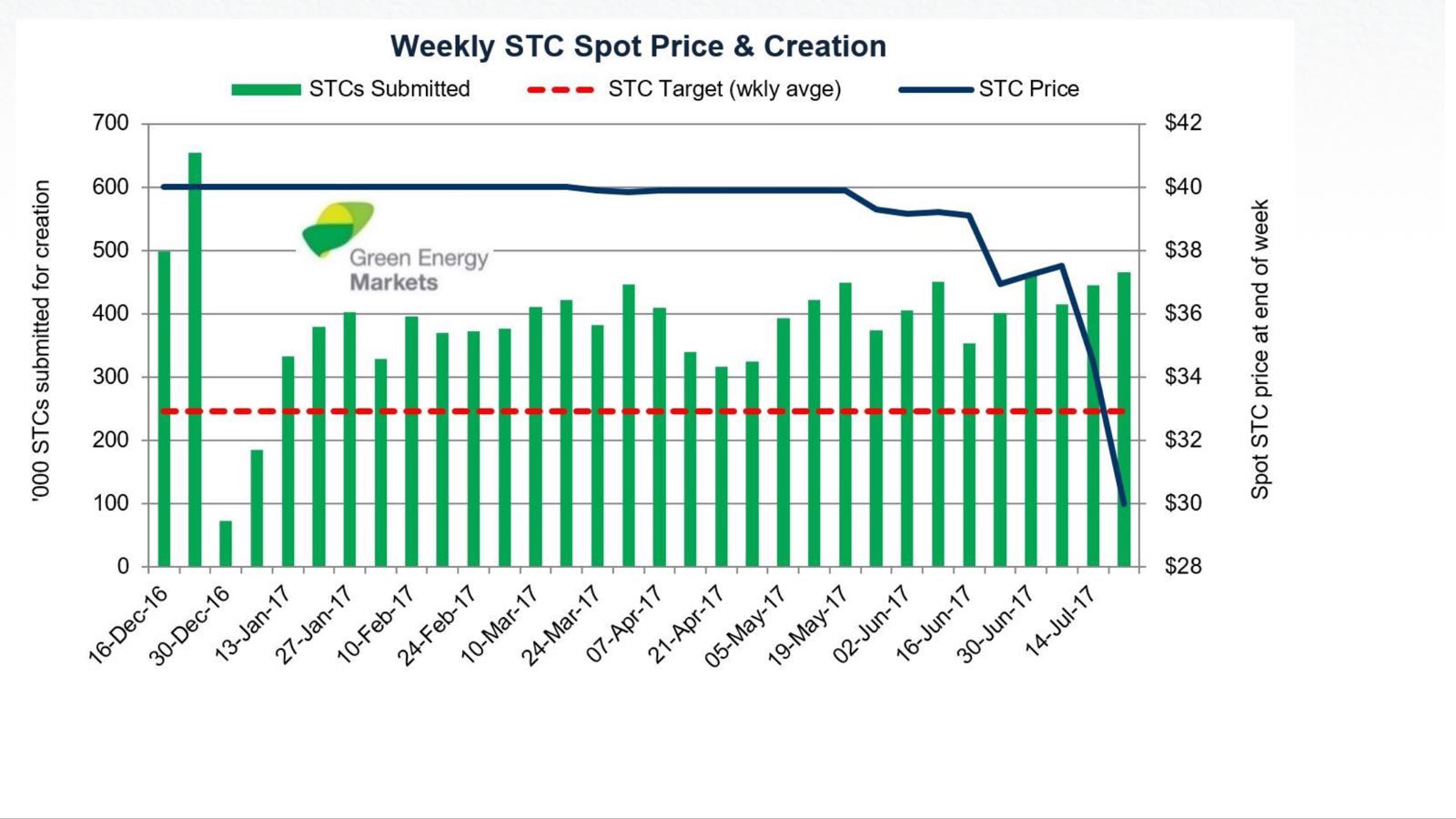

As with any commodity, the price of STCs is driven by supply and demand, and may fluctuate on a daily basis.

While the STC market has been relatively stable for the past few years, significant under-estimation of the installation of renewable energy systems for late 2016/2017 has lead to a dramatic over-supply of STCs.

This over-supply has lead to a sharp drop in the price of STCs in recent days as Liable Entities have fulfilled their quotas for the second quarter, and the current STC surplus exceeds requirements for the upcoming trading periods.

STC Market Supply & Price, courtesy of Green Energy Markets

This means that the trend of lower STC prices is anticipated to continue for some time.

For further information, please see the Clean Energy Regulator’s Website or Green Energy Markets.